Informazioni su An Post Money

Discover the Power of An Post Money App

The An Post Money App is designed to help you take control of your finances and make every penny count. With a wide range of features tailored to meet your needs, this app offers an easy and convenient way to manage your money.

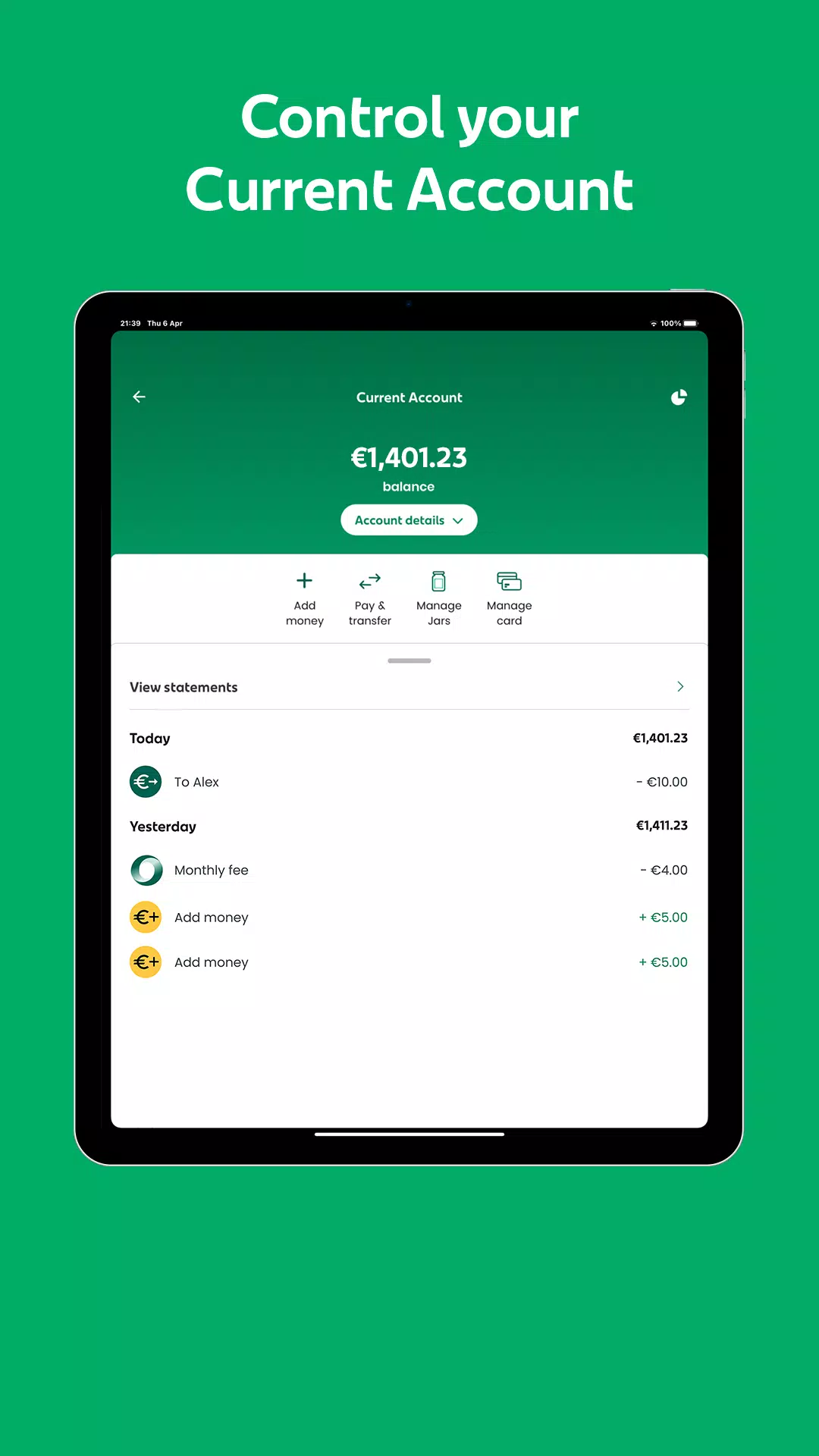

Personalized Current Accounts

Enjoy the convenience of a personal account with the An Post Money app. Our current accounts come with low fees and a host of features that make managing your finances simple:

- Sign up on the app: Effortlessly create your account directly from your smartphone.

- Jars for savings: Set aside money for various goals using Jars.

- Round Up feature: Automatically round up purchases to help you reach your financial goals faster.

- Card Management: Freeze or unfreeze your cards instantly through the app.

- Emergency Cash: Get quick access to cash from any post office in case your card is damaged, lost, or stolen.

- Contactless Payments: Pay seamlessly using Apple Pay, Google Pay™, or Fitbit Pay.

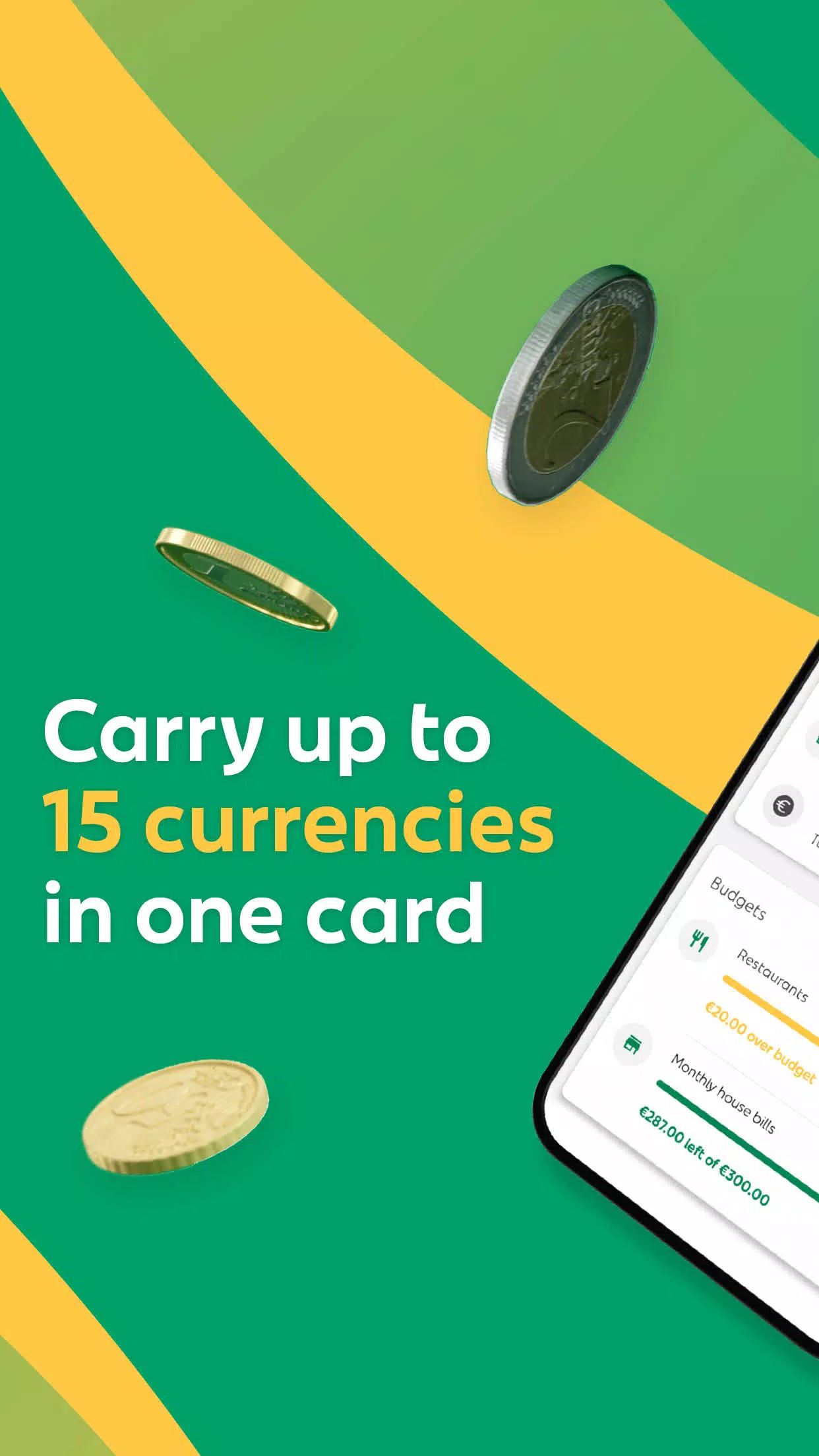

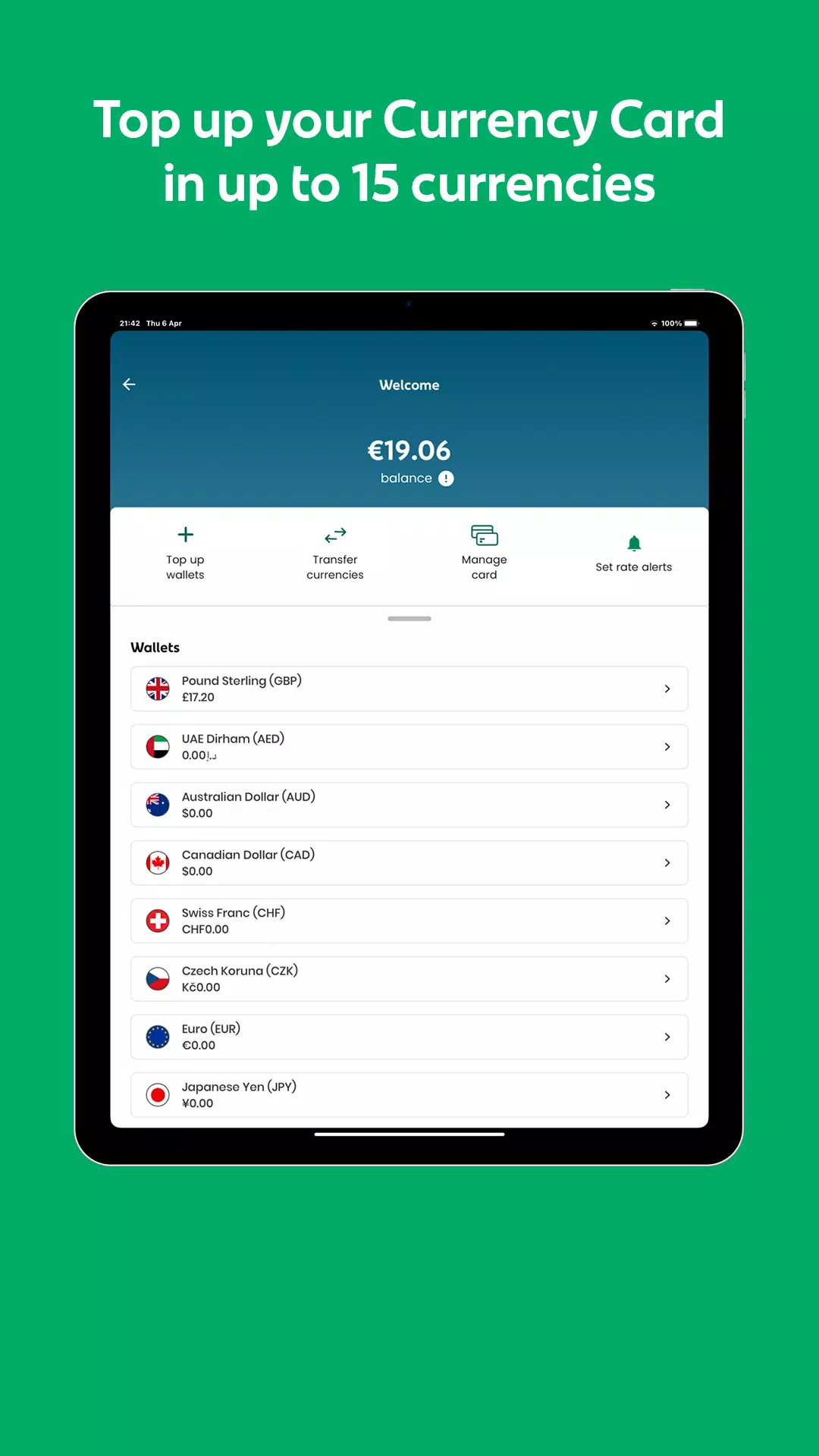

Travel Money Made Easy

Traveling abroad? The An Post Money app offers a Currency Card to help you manage your foreign currency efficiently:

- Multiple Currencies: Carry up to 15 different currencies for seamless spending both in-store and online.

- Commission-Free Top-Up: Easily add funds without worrying about additional charges.

- Real-Time Monitoring: Keep track of your spending and monitor your card's status.

- Rate Alerts: Receive notifications when your preferred exchange rate is reached.

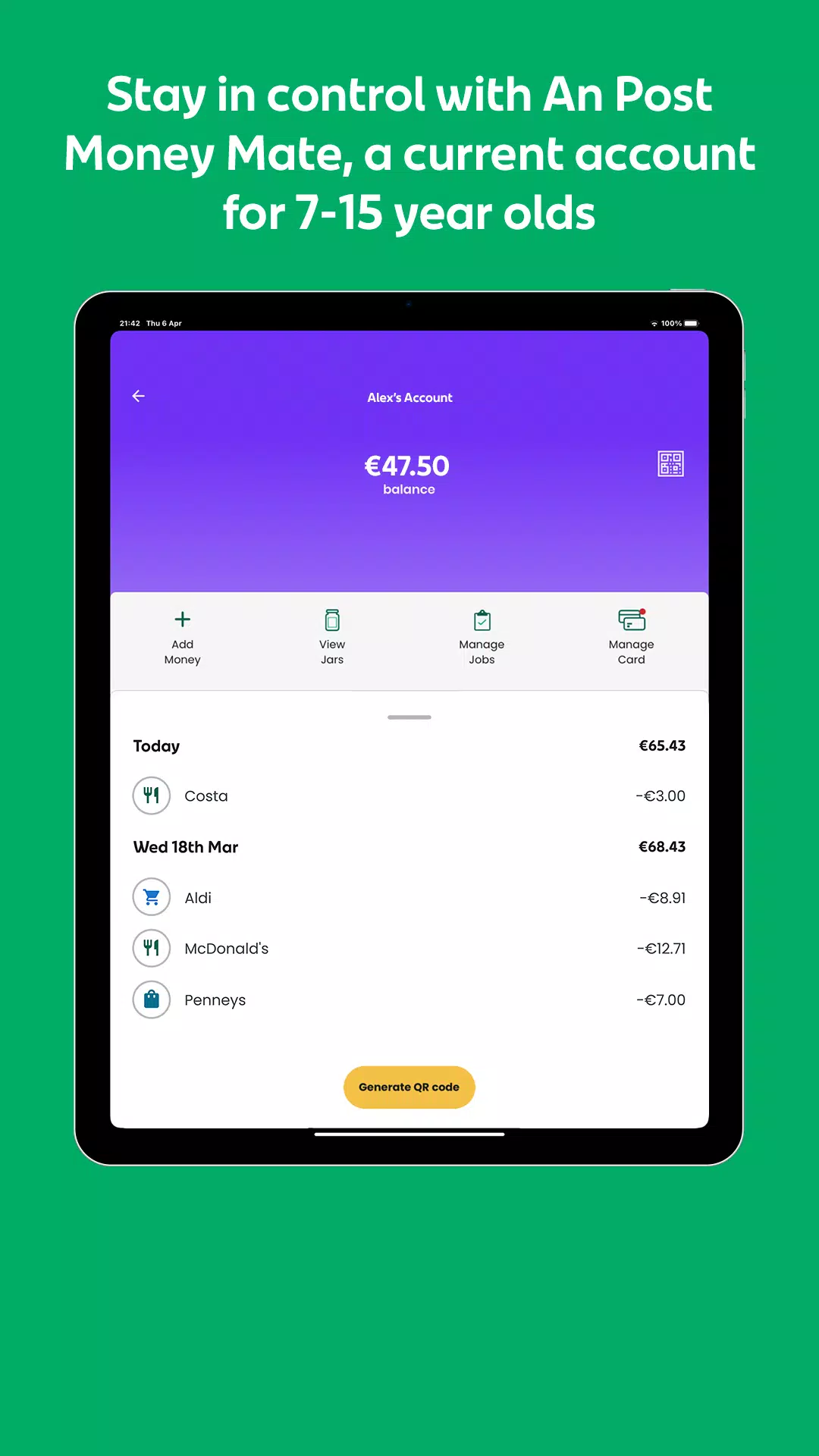

Teach Your Kids Financial Responsibility

Introducing An Post Money Mate, a fantastic tool for teaching children aged 7-15 about money management:

- Child-Friendly Account: Open a current account for your child with easy sign-up through the app.

- Debit Card for Kids: Give your child their own debit card for making purchases and managing their money.

- Parental Control: Parents can view transactions, freeze cards, and set spending limits.

- Allowance and Chores: Set up a weekly allowance and assign household chores to encourage saving and responsibility.

- Free Trial: Enjoy a complimentary 3-month trial to start teaching your kids financial literacy.

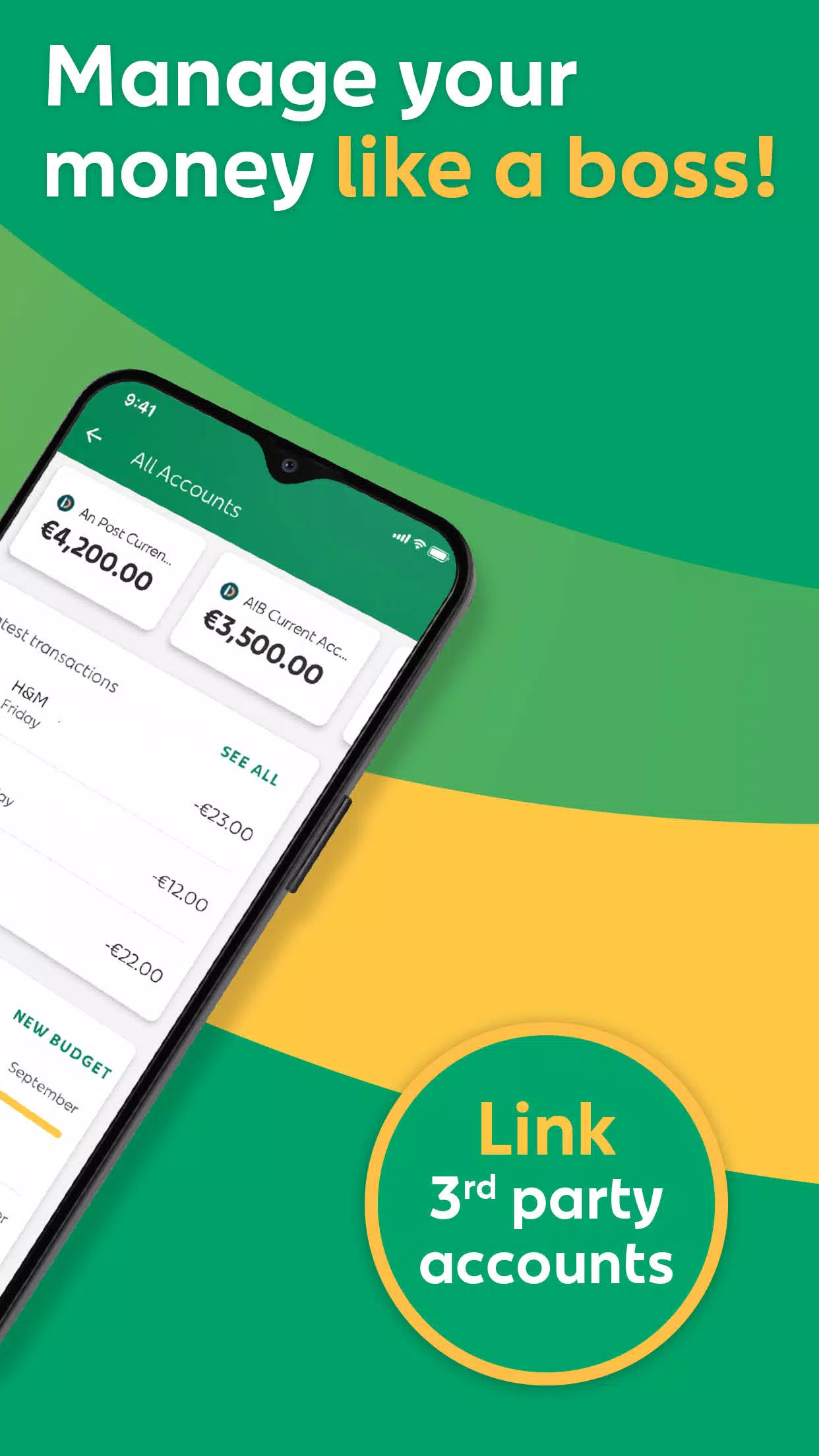

Comprehensive Money Management

Take charge of your finances with An Post Money Manager, a powerful tool designed to help you track and control your spending:

- Link Third-Party Banks: Connect your other bank accounts to manage everything in one place.

- Expense Tracking: Monitor your spending and plan future expenses effectively.

- Insights and Goals: Gain valuable insights to help you reach your financial goals faster.

No matter your financial goals or lifestyle, the An Post Money app has something for everyone. Download it today and start making your money matter more!

Note: Android version 10.0 or above is required for full functionality.

Gameplay

Screenshot di An Post Money

Vecchie versioni di An Post Money

An Post Money FAQ

1. What is the An Post Money app?

The An Post Money app provides a range of financial services, including current accounts for adults and kids, currency cards for travel, and money management tools. It is designed to make managing your finances easy and convenient

2. What can I do with the An Post Money app?

With the app, you can sign up for current accounts, get a currency card for travel money, manage your money across accounts and cards using Money Manager, set money aside in Jars, use Round Up to save change, freeze/unfreeze cards, get emergency cash, and make contactless payments

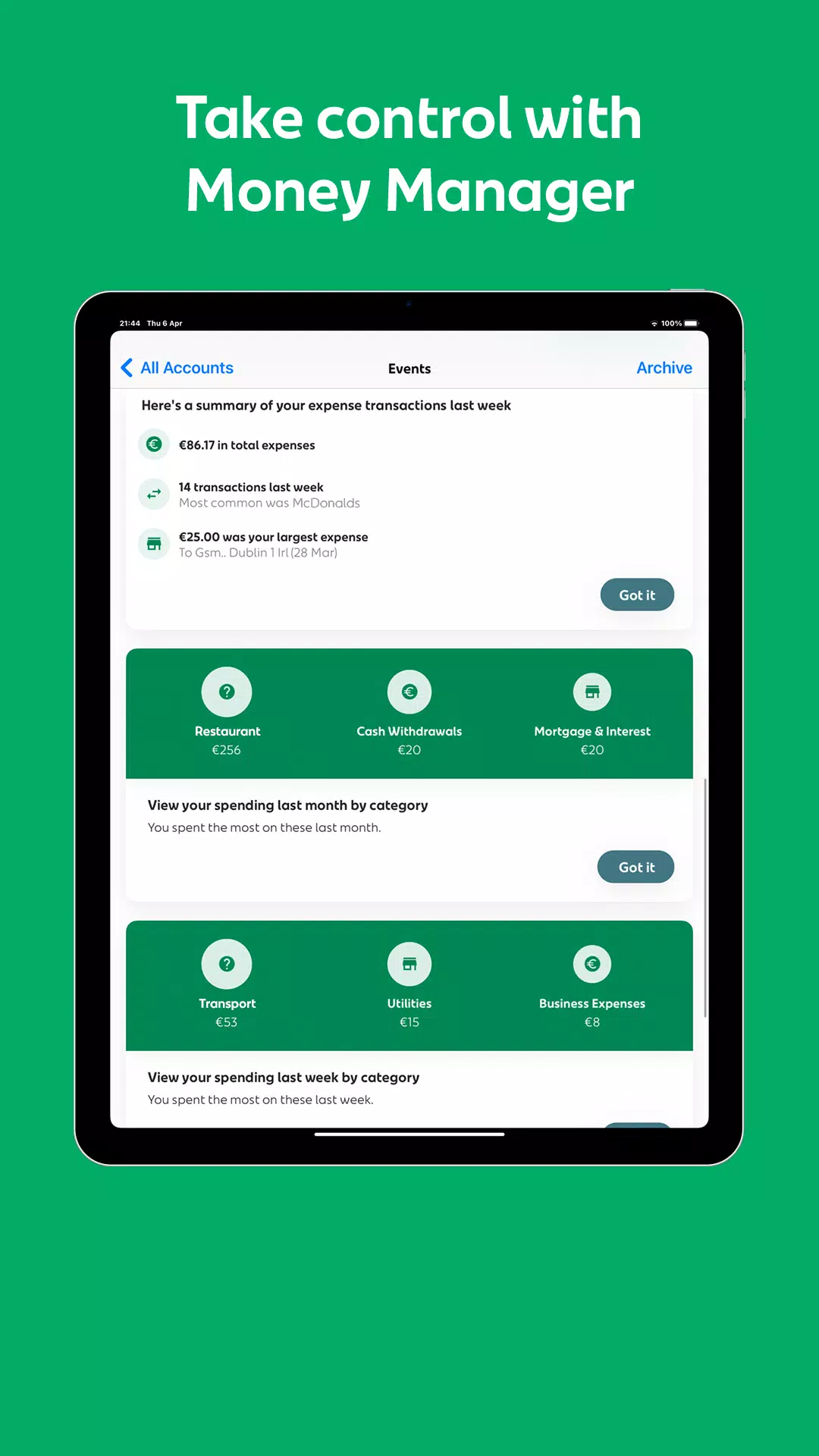

3. What is Money Manager?

Money Manager is a free tool within the app that helps you track your spending and control your finances across all your accounts, even those with other banks239. You can link your third-party bank accounts to get a breakdown of your finances, receive insights, and create budgets

4. How do I enable Money Manager?

Log into the An Post Money app, look for the pie icon, follow the explanatory screens, and accept the terms and conditions3. Alternatively, go to the menu and click on Money Manager

5. What accounts can I link to Money Manager?

You can link current accounts with An Post, Bank of Ireland, AIB, Permanent TSB, Revolut, or N263.

6. What is An Post Money Mate?

An Post Money Mate is a current account and app designed for 7-15 year olds to learn money skills, with parental controls24. Parents can see their kids’ transactions, freeze their card, and set spending limits

7. How do I sign up for a current account?

You can sign up for a current account directly through the app. New customers can set up an account from home using the app or by visiting a post office

8. What is the Currency Card?

The Currency Card is a travel money card that allows you to carry up to 15 currencies and spend worldwide and online. You can top up your card commission-free and monitor your spending

9. How do I upgrade to the new An Post Money app?

Download and open the new app, and if you used the old app, select "upgrading from old app" and follow the instructions1. If you've never used the app before, select "never used app before"

10. How do I log in to the new app?

After upgrading, log in with your email address and password. You can also set up fingerprint or Face ID login and a 5-digit app PIN for extra security

11. How do I add my products to the new app?

Tap the menu icon in the app, then tap "Add new or existing products"

12. What if my card is lost or stolen?

You can freeze your card in the app268. You can also get emergency cash from any post office if your card is damaged, lost, or stolen246.

13. Is there a fee for using the An Post Money app?

An Post does not charge for using the app, but standard charges and transaction fees apply when you use the app to enter into a transaction

14. What are the age restrictions for using the app?

You must be a resident of Ireland and over 16 years of age to use the app, unless you have a pre-existing Money Mate account

15. Where can I get help and support?

You can email customerservices@anpostmoney.com or contact customer service at 01 705 8000 from 9am to 6pm, Monday to Friday