Hurdlr Mileage, Expenses & Tax

4.7امتیاز

Oct 24, 2024آخرین به روزرسانی

40.8.3نسخه

نحوه نصب فایل .IPA

اشتراک گذاری

درباره Hurdlr Mileage, Expenses & Tax

Are you self-employed, an independent contractor or agent? Do you freelance, have a gig, or drive for Uber or Lyft? Hurdlr’s business expenses and mileage tracker saves you thousands of dollars in IRS tax deductions. Plus, easily capture receipts and create expense reports.

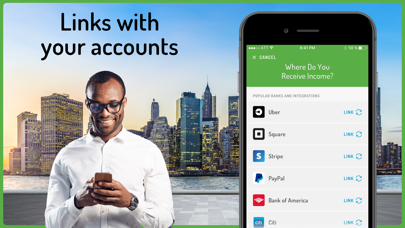

Hurdlr connects with thousands of leading banks as well as Uber, FreshBooks, Square, Stripe and Paypal to import your income and expenses automatically for easy income tax calculations.

You’re one step away from throwing away your shoebox of receipts and mileage logs.

Hurdlr's free version offers more than mileage-only alternative apps like MileIQ, including expense, income tax, and semi-automatic mileage tracking. Our premium version has more robust automation features and is half the price of alternative apps like QuickBooks Self-Employed.

Hurdlr also has a detailed business tax tracker for 2020 quarterly tax accounting.

HURDLR IS PERFECT FOR 1099:

• Independent Contractors

• Uber & Lyft Drivers

• Freelancers

• Small Business Owners

• Self-Employed Entrepreneurs

• Postmates Couriers

• Airbnb Hosts

• Real Estate Agents

AUTOMATIC MILEAGE TRACKER

Hurdlr’s IRS mileage tracking helps 1099’s claim maximum tax deductions. Let Hurdlr track mileage for work, and deduct 57.5 cents for every mile you drive. Perfect for Uber drivers, Lyft drivers, and other mobile independent contractors.

AUTO-TRACK EXPENSES & IDENTIFY TAX DEDUCTIONS

Connect with over 9,500 banks to auto-track business expenses and identify valuable 1099 tax deductions for independent contractors and small business owners.

Export detailed expense reports with receipts and send them to any email address or to your tax preparer.

SELF-EMPLOYED TAX ACCOUNTING

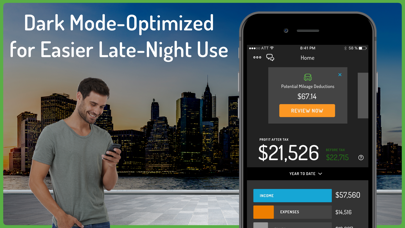

See your complete state, federal, and self employed business tax calculator breakdown. Hurdlr provides real-time year end and quarterly tax estimates for independent contractors at the tap of a button. Watch as your business expenses and IRS mileage tax deductions lower your 1099 taxes saving you thousands of dollars.

INCOME REPORT

Hurdlr sends you a real-time notification anytime you get paid, so you’ll always know how much money you’re making.

OPTIMIZED FOR LOW BATTERY USAGE

Because you’re on the road a lot, we’ve designed Hurdlr to work without draining your battery, even with heavy usage.

BUILT BY ENTREPRENEURS LIKE YOU

Our team of experienced entrepreneurs worked closely with users like you to build the ideal business expense, income, tax, and mileage tracker, so you can focus on doing the work you love.

CONTACT US

We strive to provide the best customer support, answering all of your questions 1-on-1. Talk to us live, directly from within Hurdlr.

HURDLR PREMIUM

• $9.99 a month or $99.99 a year (Save 16%).

• Premium Features:

• Auto-Mileage Tracking

• Auto-Expense Tracking

• Auto-Income Tracking

• Real-Time Tax Calculations

• Speed Tagging

• Work Hours

• BONUS: Hurdlr Premium can be deducted as a business expense when you file taxes.

Note: Monthly subscriptions renew each month, and annual subscriptions renew each year, unless auto-renew is turned off at least 24 hours before the end of the current subscription period. Your iTunes account will be charged within 24 hours prior to the end of the current period. You can turn off auto-renew at any time from your iTunes account settings. Any unused portion of a free trial will be forfeited if you purchase a subscription before the trial expires.

MORE INFORMATION

Learn about our privacy policy at https://hurdlr.com/privacy

Understand our terms of use at https://hurdlr.com/terms

Hurdlr connects with thousands of leading banks as well as Uber, FreshBooks, Square, Stripe and Paypal to import your income and expenses automatically for easy income tax calculations.

You’re one step away from throwing away your shoebox of receipts and mileage logs.

Hurdlr's free version offers more than mileage-only alternative apps like MileIQ, including expense, income tax, and semi-automatic mileage tracking. Our premium version has more robust automation features and is half the price of alternative apps like QuickBooks Self-Employed.

Hurdlr also has a detailed business tax tracker for 2020 quarterly tax accounting.

HURDLR IS PERFECT FOR 1099:

• Independent Contractors

• Uber & Lyft Drivers

• Freelancers

• Small Business Owners

• Self-Employed Entrepreneurs

• Postmates Couriers

• Airbnb Hosts

• Real Estate Agents

AUTOMATIC MILEAGE TRACKER

Hurdlr’s IRS mileage tracking helps 1099’s claim maximum tax deductions. Let Hurdlr track mileage for work, and deduct 57.5 cents for every mile you drive. Perfect for Uber drivers, Lyft drivers, and other mobile independent contractors.

AUTO-TRACK EXPENSES & IDENTIFY TAX DEDUCTIONS

Connect with over 9,500 banks to auto-track business expenses and identify valuable 1099 tax deductions for independent contractors and small business owners.

Export detailed expense reports with receipts and send them to any email address or to your tax preparer.

SELF-EMPLOYED TAX ACCOUNTING

See your complete state, federal, and self employed business tax calculator breakdown. Hurdlr provides real-time year end and quarterly tax estimates for independent contractors at the tap of a button. Watch as your business expenses and IRS mileage tax deductions lower your 1099 taxes saving you thousands of dollars.

INCOME REPORT

Hurdlr sends you a real-time notification anytime you get paid, so you’ll always know how much money you’re making.

OPTIMIZED FOR LOW BATTERY USAGE

Because you’re on the road a lot, we’ve designed Hurdlr to work without draining your battery, even with heavy usage.

BUILT BY ENTREPRENEURS LIKE YOU

Our team of experienced entrepreneurs worked closely with users like you to build the ideal business expense, income, tax, and mileage tracker, so you can focus on doing the work you love.

CONTACT US

We strive to provide the best customer support, answering all of your questions 1-on-1. Talk to us live, directly from within Hurdlr.

HURDLR PREMIUM

• $9.99 a month or $99.99 a year (Save 16%).

• Premium Features:

• Auto-Mileage Tracking

• Auto-Expense Tracking

• Auto-Income Tracking

• Real-Time Tax Calculations

• Speed Tagging

• Work Hours

• BONUS: Hurdlr Premium can be deducted as a business expense when you file taxes.

Note: Monthly subscriptions renew each month, and annual subscriptions renew each year, unless auto-renew is turned off at least 24 hours before the end of the current subscription period. Your iTunes account will be charged within 24 hours prior to the end of the current period. You can turn off auto-renew at any time from your iTunes account settings. Any unused portion of a free trial will be forfeited if you purchase a subscription before the trial expires.

MORE INFORMATION

Learn about our privacy policy at https://hurdlr.com/privacy

Understand our terms of use at https://hurdlr.com/terms

تصاویر Hurdlr Mileage, Expenses & Tax

Hurdlr Mileage, Expenses & Tax FAQ

چگونه می توانم Hurdlr Mileage, Expenses & Tax را از PGYER IPA HUB دانلود کنم؟

آیا Hurdlr Mileage, Expenses & Tax در PGYER IPA HUB رایگان برای دانلود است؟

آیا برای دانلود Hurdlr Mileage, Expenses & Tax از PGYER IPA HUB نیاز به حساب کاربری دارم؟

چگونه می توانم یک مشکل با Hurdlr Mileage, Expenses & Tax در PGYER IPA HUB گزارش دهم؟

آیا این را مفید یافتید؟

بله

خیر

پرطرفدارترین

Sing It - Ear TrainerA must app for every musician, singer, or just for fun.

Test,train, and improve your musical ear an

Tube PiP - PiP for YouTubeTube PiP - the ultimate YouTube companion for iOS:

1. Picture in Picture (PiP) Playback: Watch YouT

Papaya Ouch!In the game Papaya Ouch!, you can experience backpack management, tower defense, TD, merge, match 2,

Lets Go VPNLets Go VPN, the most advanced VPN, is designed by a team of top developers who strive to ensure all

Paprika Recipe Manager 3Organize your recipes. Create grocery lists. Plan your meals. Download recipes from your favorite we

War Pigeons UnboundedWar is coming. Deep down in top secret military labs they have evolved, mutated - and escaped. The f

Procreate PocketApp of the Year winner Procreate Pocket is the most feature-packed and versatile art app ever design

Cowboy Westland survival runAre you ready to take part in the #1 exciting 3D western adventure? Cowboy Westland survival run mak

Max: Stream HBO, TV, & MoviesIt’s all here. Iconic series, award-winning movies, fresh originals, and family favorites, featuring

TonalEnergy Tuner & MetronomeFor musicians from pros to beginners, whether you sing, play a brass, woodwind or stringed instrumen

SkyView®SkyView® brings stargazing to everyone. Simply point your iPhone, iPad, or iPod at the sky to identi

Ninja Dash 2015Ninja Dash 2015 is the fast paced running game!<br>On these maze fields, rush to the end of this nin

Tami-Live Chat&VideoTami is an app that records daily life and ideas.<br><br>You can use it to record your every day, wh

SALE Camera - marketing camera effects plus photo editorSALE Camera Help you create the best Business to consumer Stock Photos and Images. provides 300 filt

DevTutor for SwiftUI"DevTutor" is an application designed to assist developers in creating exceptional apps using SwiftU

Mokens League SoccerDive into Mokens League Soccer and experience the new era of soccer gaming!

Esports for Everyone: W

Zombie ZZOMBIE ENDLESS RUNNER LIKES NO OTHER!<br><br>WHY?<br><br>* Awesome graphic quality!<br><br>* Simplif

Dead Z - Zombie SurvivalCatastrophic explosion at the Omega Labs started the apocalypse, now spreading across the Earth.

Ta

HotSchedulesHotSchedules is the industry's leading employee scheduling app because it’s the fastest and easiest

ChatGPTIntroducing ChatGPT for iOS: OpenAI’s latest advancements at your fingertips.

This official app is

Disney StoreDisney Store is your official home for exclusive collections, designer collaborations, and one-of-a-

fight back tennisa Pong game with Tennis style, the gameplay itself is very simple, you can using Touch. Ball speed w

Dr. Mina AdlyMina Adly mobile app provides students with portable instant access to a selection of services.

Usi

iVerify BasiciVerify Basic is your gateway to enhanced device security and threat awareness, offering a glimpse i